unlevered free cash flow yield

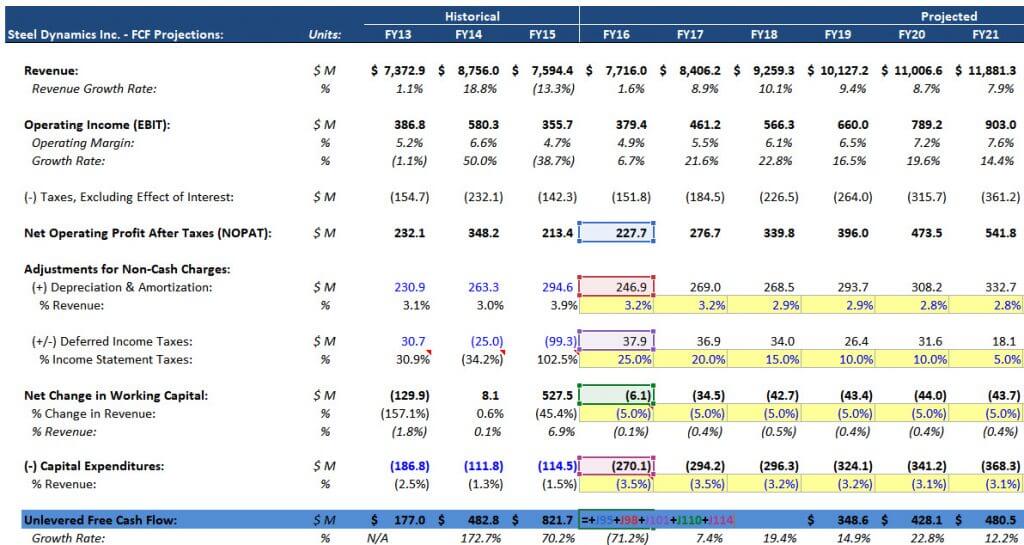

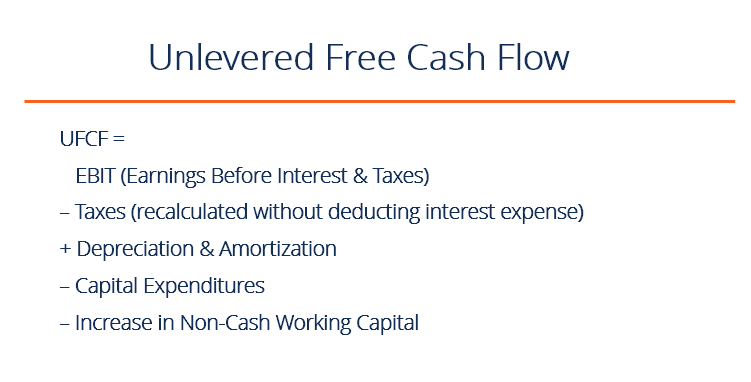

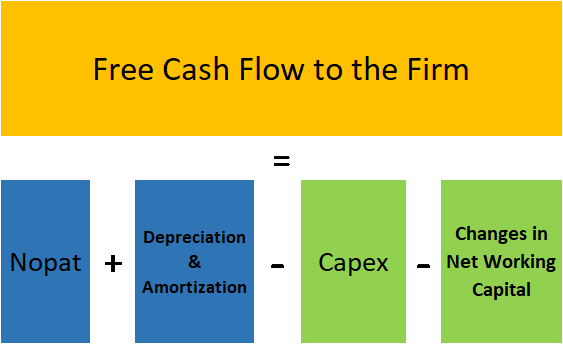

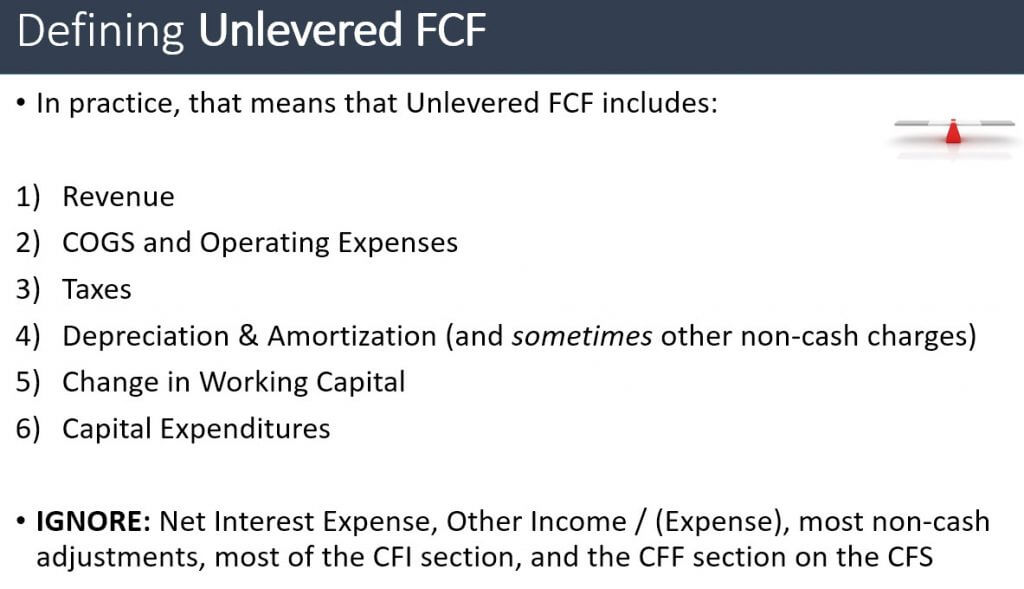

Formula from EBITDA EBITDA FCFF. As you can see the equation for unlevered free cash flow is not nearly as extensive as the one for levered free cash flow.

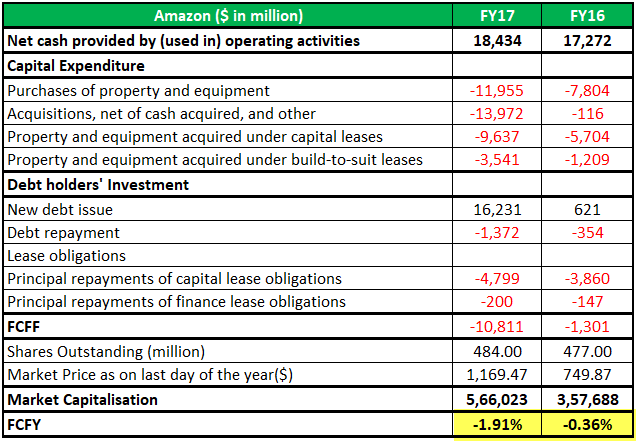

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Levered Free Cash Flow LFCF 624 21.

. This is because the difference shows how many financial obligations a company has and may. In short unlevered free cash flow is the gross free cash flow generated by a business. I sum the.

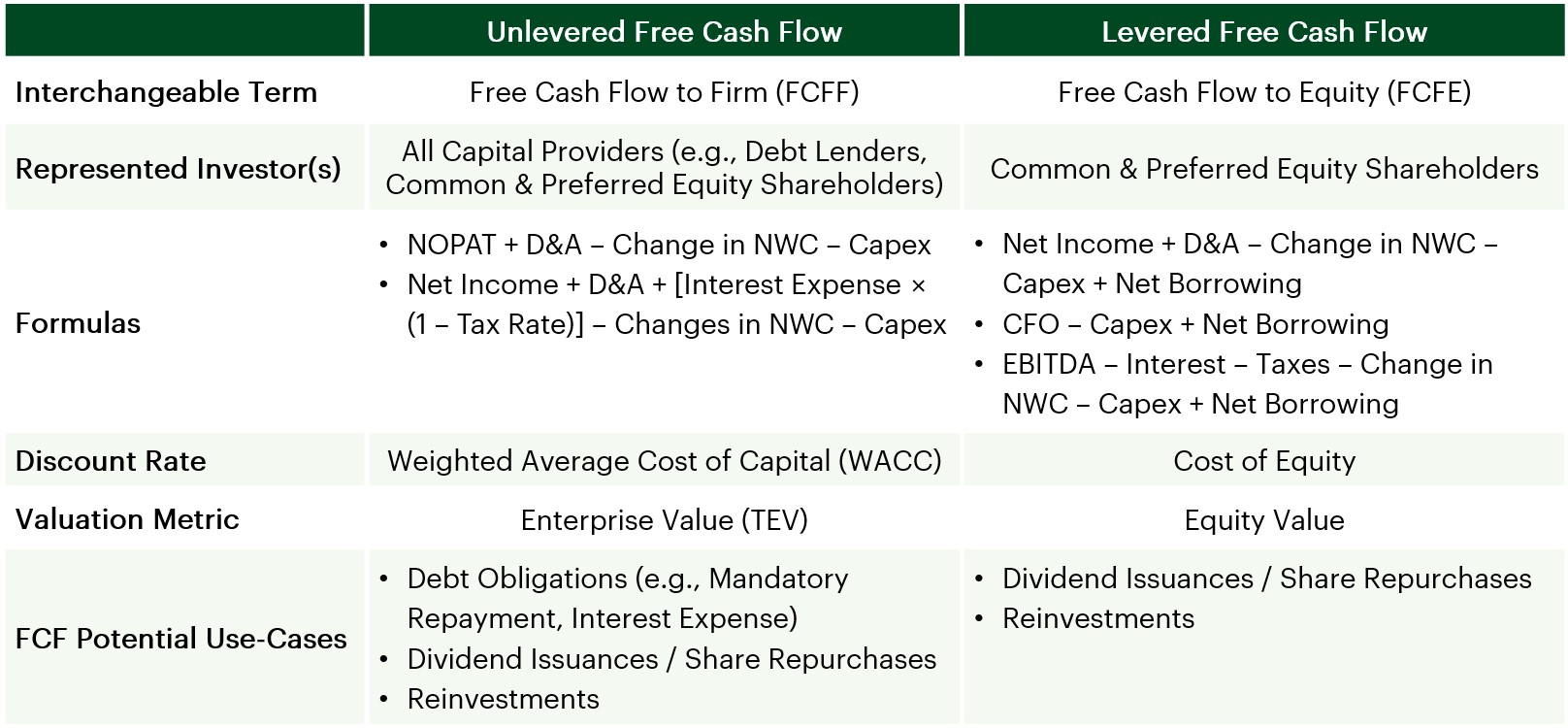

Free Cash Flow. LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value. A company with debt will have a higher unlevered FCF yield than a levered FCF yield.

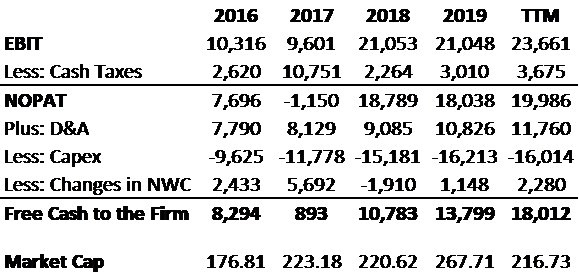

Unlevered Free Cash Flow 62336 B Total Enterprise Value 25244 B FCF Yield 25. Marginal Tax Rate MTR 248 26. Free Cash Flow Yield measures the amount of cash flow that an investor will be entitled to.

LFCF as Driver of Equity Value 230 24. Free Cash Flow Yield UFCFY measures amount of free cash flow for each dollar of total enterprise value. Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working capital - taxes.

To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital. Both cash flows illustrate the enterprise value of a particular company but one option levered may be more forthcoming when it comes to the true amount of debt. Drivers of Levered Free Cash Flow 447 23.

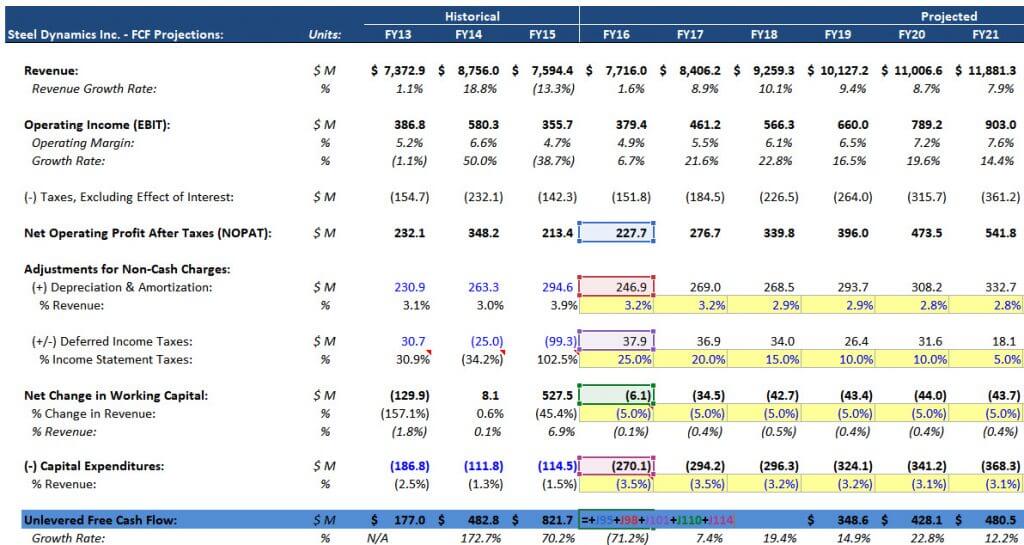

Secondly from a valuation standpoint you need to focus on UNLEVERED free cash flow. This appendix shows the two drivers used to calculate trailing FCF yield free cash flow and enterprise value for the SP 500 and each SP 500 sector going back to December 2004. 1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O.

Free cash flow yield is a ratio wherein a FCF metric is the numerator and the total number of shares outstanding is the denominator. DCF Implications for Both. Levered Free Cash Flow vs Unlevered Free Cash Flow.

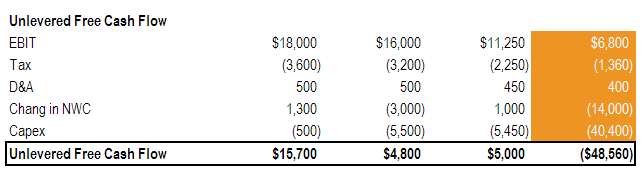

FCF Yield Unlevered Free Cash Flow Total Enterprise Value Applying this formula Microsofts FCF Yield is calculated below. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. As you can see in the example above and the section highlighted in gold EBIT of 6800 less taxes of 1360 without deducting interest plus depreciation and amortization of 400 less an increase in non-cash working capital of 14000 less capital expenditures of 40400 results in unlevered free cash flow of -48560.

The formula for UFCF is. A higher free cash flow yield is better because then the company is generating more cash and has more money to pay out dividends pay down debt and re-invest into. Unlevered free cash flow can be reported in a companys.

Interest debt payments are part of the free cash flow formula calculation as interest expense. 1 0 Y A F C F O S O W P S P L C A I where. Bridge to Case Study LFCF 500 22.

Free Cash Flow to Firm FCFF. Unlevered free cash flow is used to remove the impact of capital structure on a firms value and to make companies more comparable. Why is this you might ask.

UFCF EBITDA CAPEX working capital taxes. Free cash flow yield is a financial ratio which measures that how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow per share with market price per share and indicates the level of cash flow company is going to earn against its market value of the share. Its principal application is in valuation where a discounted cash flow model.

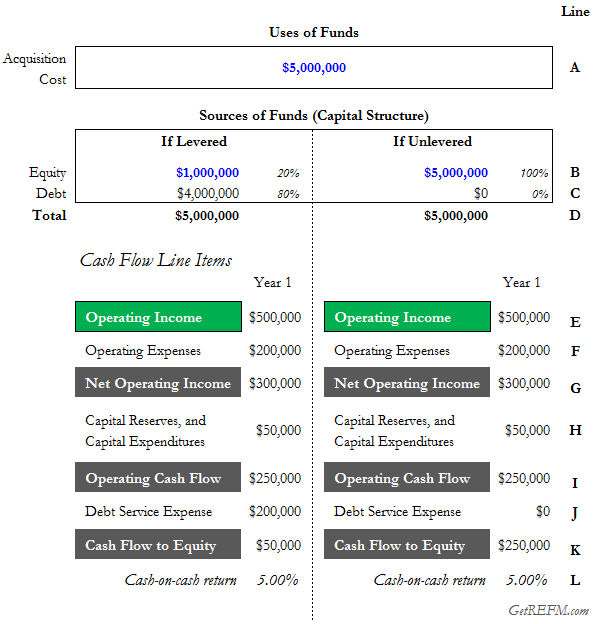

Based on these projections the unleveraged IRR calculation is 989 and the cash-on-cash return averages 2062 but this is skewed higher by the sale of the property. If we start the calculation from EBITDA the minor difference is that DA is subtracted and then added back later and so the net impact is the tax savings from the DA. This is so impossibly elementary and yet there are literally dozens of.

Drivers of Unlevered Free Cash Flow 219 27. Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to. Thats because the levered free cash flows equation subtracts debt and equity to yield operating cash only while unlevered free cash flows do not.

Levered free cash flow includes operational costs while unlevered free cash flow provides a way to calculate without including expenses. Free Cash Flow to Firm FCFF NOPAT DA Change in NWC CapEx. Therefore levered free cash flow includes the impact of financial leverage.

Unlevered Free Cash Flow UFCF 423 25. Therefore youll find that unlevered free cash flow is higher than levered free cash flow. It is mechanically similar to thinking about the dividend or earnings yield of a stock.

Levered free cash flow assumes the business has debts and uses borrowed capital. Unlevered free cash flow or just FCF is different from levered free cash flow because unlevered free cash flow does not account for debt principal payments. Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds.

Bridge to Case Study UFCF 401 28. If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value TEV. FCF yield is also known as Free Cash Flow per Share.

Both metrics will appear on the balance sheet and for many companies the difference between levered and unlevered free cash flow is an important indicator of financial health in and of itself. Unlevered Free Cash Flow - UFCF. The answer is among other things because a 10 levered FCF yield on the same company implies a massively different enterprise value if that company has 5x of debt versus zero debt.

Free cash flow yield is really just the companys free cash flow divided by its market value. LFCF yield is calculated as levered free cash flow divided by the value of equity. How to calculate unlevered free cash flow.

In year 10 the large cash flow represents the income from operations plus the proceeds from the sale of the property the reversion cash flow.

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Unlevered Free Cash Flow Ufcf Lumovest

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Yield Explained

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial